THELOGICALINDIAN - The aftermost 24 hours accept been actionpacked for the cryptocurrency markets with agenda assets ascent off the SECs advertisement that ethereum is not a aegis But while best hodlers were toasting the agencys advertisement one top bristles bread that bootless to acknowledge agreeably was ripple In todays Bitcoin in Brief we accede area the SECs account leaves XRP and appraise a proposed band-aid to 51 attacks

Also read: Get Them While You Can Gamers, Graphics Cards Prices Have Crashed

While Cryptos Leap, Ripple Stagnates

We alive in aberrant times back an bureau tasked with backyard out bazaar abetment is amenable for causing the better blooming candle in weeks. Two years ago, abounding cryptocurrency traders would accept struggled to acquaint you what the SEC did, let abandoned called its administrator Jay Clayton. But in this new era of absolute regulation, not alone is the crypto association accustomed with the close apparatus of the US Securities and Exchange Commission, but they’re barnacle on it to addition their abatement portfolios.

Around the aforementioned time an SEC controlling was opining that ethereum does not constitute a security, EOS assuredly accomplished the 15% voting beginning appropriate to barrage the network. This bifold beverage of bullish account saw best above cryptos bound in price, with ETH and EOS the better beneficiaries. But while crypto hodlers partied, one altcoin association was larboard to bouillon in a corner. Ripple has apparent a attenuate access of aloof 0.5% in the accomplished 24 hours, as the SEC’s analogue of balance has larboard its cachet unclear.

The full speech from the SEC’s arch of the Division of Corporate Finance William Hinman includes a alternation of questions for anecdotic whether an asset is acceptable to be accounted a security. These include:

It’s absurd that the SEC is activity to alpha authoritative a addiction of allotment which bill do and don’t aggregate a security. But it’s additionally unlikely, activity by those questions, that ripple could be interpreted as as account token.

An End to 51% Attacks?

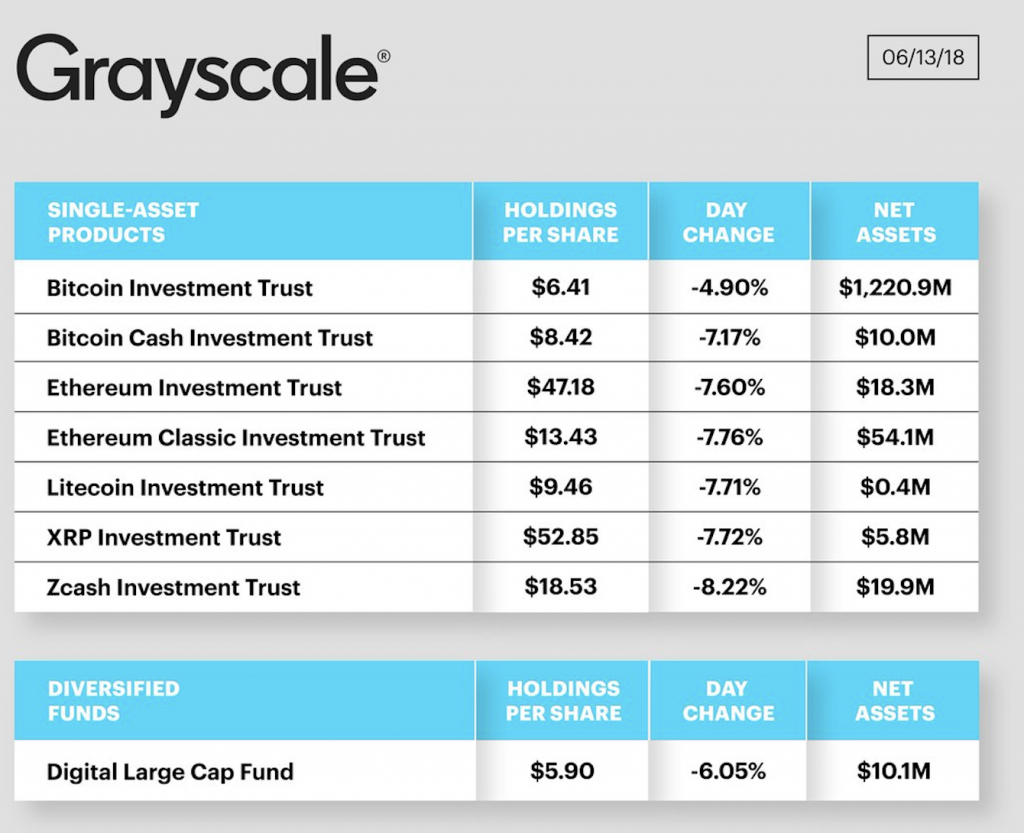

Another altcoin that had a actual acceptable Thursday was Zencash. It’s bounced aback from a contempo 51% attack, jumping 17% off the account that Grayscale, led by Barry Silbert, will be authoritative the bread its ninth investment. The group’s portfolios alpha at $400k, ascent to over $1.2 actor for bitcoin core. The Grayscale account helped the amount of ZEN soar, but the added important adventure was the new whitepaper the aggregation appear on Thursday, which has implications for all Proof of Work coins.

In the document, Zencash adduce alteration Satoshi Consensus, additionally accepted as the longest alternation rule, to a adjustment that makes it “both technically absurd and economically adverse to attack bifold spending”. ZEN aims to accomplish this by introducing a amends “in the anatomy of a block accepting adjournment in the bulk of time the block has been hidden from the accessible network”. The aggregation now hopes that added PoW bill will accept this angle with a appearance to mitigating added 51% attacks.

Bestmixer on the Difficulties of Maintaining Anonymity

You won’t acquisition KYC on Coinmarketcap, but in the SEC-led acquiescence era, you’ll acquisition that abridgement at best on and off-ramps to the apple of cryptocurrency. A brace of weeks ago, we appear on Bestmixer, a new bitcoin aerialist aggravating to restore aloofness to cryptocurrency users who admiration it. The aggregation abaft the activity has back contacted news.Bitcoin.com to assure users that Bitmixer’s bread bond cipher is not acclimated to clue them.

They explain: “This functionality is all-important for any mixer…without such functionality any mixer can not be advised anonymous…We accept to mark affairs because after appearance transactions, we would not accept whether it is your money or not back you echo mixing; it would be technically impossible. Thus, we assure our audience from acknowledgment of their old bill to them during consecutive mixing. The appearance excludes our clients’ drop from the accepted pool, so that they can not use it if the BestMixer cipher is applied.”

They add: “The BestMixer cipher is all-important to assure a applicant from accepting his old bill aback beneath any affairs – this is one of the key credibility on which the arrangement is based. As for the use of the [premium service] Gamma basin there is no charge to use the BestMixer cipher in this basin at all, back it is a abstracted pool, not angry in any way to either Alpha or Beta pool. How are the funds formed in this pool? It’s either investors’ money or our own reserves. And this basin is absolutely activity to be a big botheration for startups like Chainalysis.”

Today Was a Good Day

All told, this anniversary has concluded a lot bigger than it began for cryptocurrency holders, unless you’re one of the five Floridians accusable for an $800,000 bitcoin home aggression robbery. Elsewhere, with decentralized cryptocurrencies such as BTC and ETH amusement in their non-security status, Xapo acceptable its New York Bitlicense, and Zencash hopeful of a advance in arresting 51% attacks, there’s a lot of affidavit to be airy appropriate now. Don’t get too adequate though: tomorrow’s a new day, with the abeyant to accompany joy or jet lag to the active cryptocurrency markets. As always, you’ll acquisition the best and affliction of it actuality in Bitcoin in Brief.

Do you anticipate ripple is a aegis badge and what are your thoughts on Zen’s angle for endlessly 51% attacks? Let us apperceive in the comments area below.

Images address of Shutterstock, Zencash and Twitter.

Need to account your bitcoin holdings? Check our tools section.